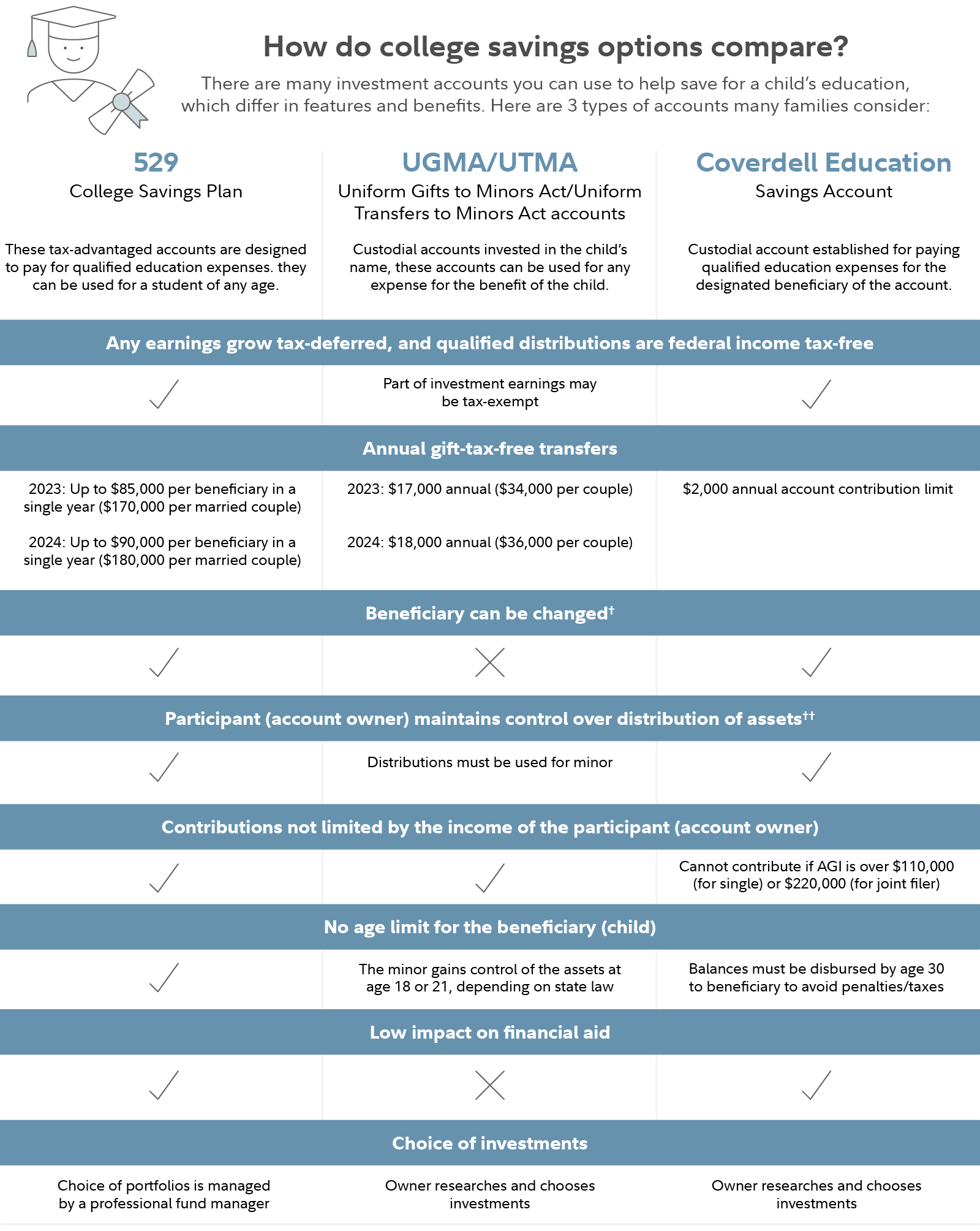

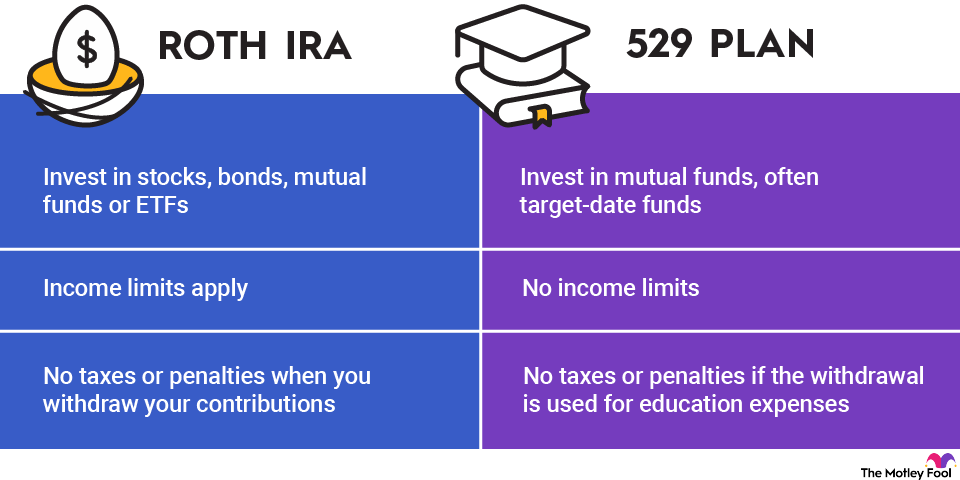

New 529 Plan Rules 2024 Chart – Investing in a 529 plan rule in 2024. A Roth IRA is one of the best retirement plans for investing in stocks, bonds, and other securities. After-tax dollars fund Roth IRAs, so you won’t pay income . A 529 plan is a tax-advantaged way for parents to save for their children’s education expenses. The IRS doesn’t impose a contribution limit on 529 plans, unlike for other tax-advantaged accounts such .

New 529 Plan Rules 2024 Chart

Source : www.investopedia.comSaving for college: The new 529 to Roth IRA transfer rule

Source : www.journalofaccountancy.com529 Plan Basics Fidelity

Source : www.fidelity.comUnderstanding the New 529 College Savings Plan to Roth IRA

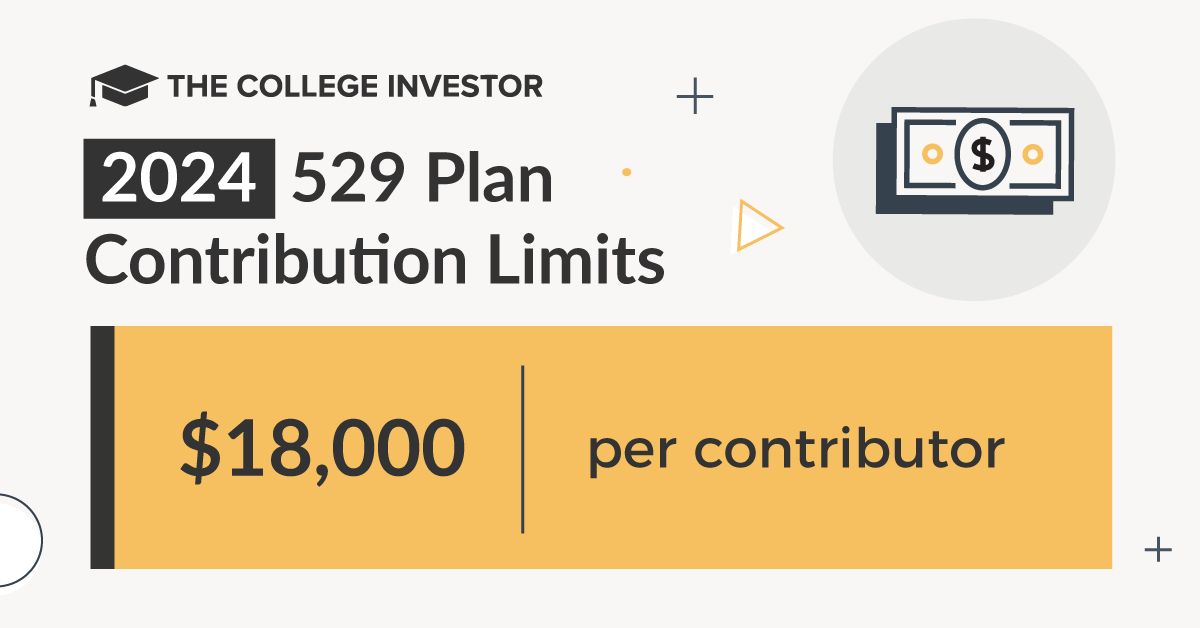

Source : www.linkedin.com529 Plan Contribution Limits For 2024

Source : thecollegeinvestor.comSaving for college: The new 529 to Roth IRA transfer rule

Source : www.journalofaccountancy.comNew for 2024: 529 transfers to a Roth IRA | MassMutual

Source : blog.massmutual.comHow Much You Can Contribute to a 529 Plan in 2024

Source : www.savingforcollege.comIRA Contribution Limits And Income Limits For 2023 And 2024

Source : thecollegeinvestor.comRoth IRA vs. 529 Plan for College Savings: Which Is Better? | The

Source : www.fool.comNew 529 Plan Rules 2024 Chart 529 Plan Contribution Limits in 2024: Inflation-fueled tax breaks, boosted contribution limits, and SECURE Act 2.0 changes create strategic opportunities for advisers to help clients save more, withdraw smarter, and maximize retirement . The income thresholds to be eligible for a Roth IRA are also higher in 2024. For single and head-of-household taxpayers, the income phase-out range is between $146,000 and $161,000, up from between .

]]>

:max_bytes(150000):strip_icc()/529-plan-contribution-limits-2016.asp_Final-28fe6ce80ec7400fb9e62e35624d8c2b.jpg)