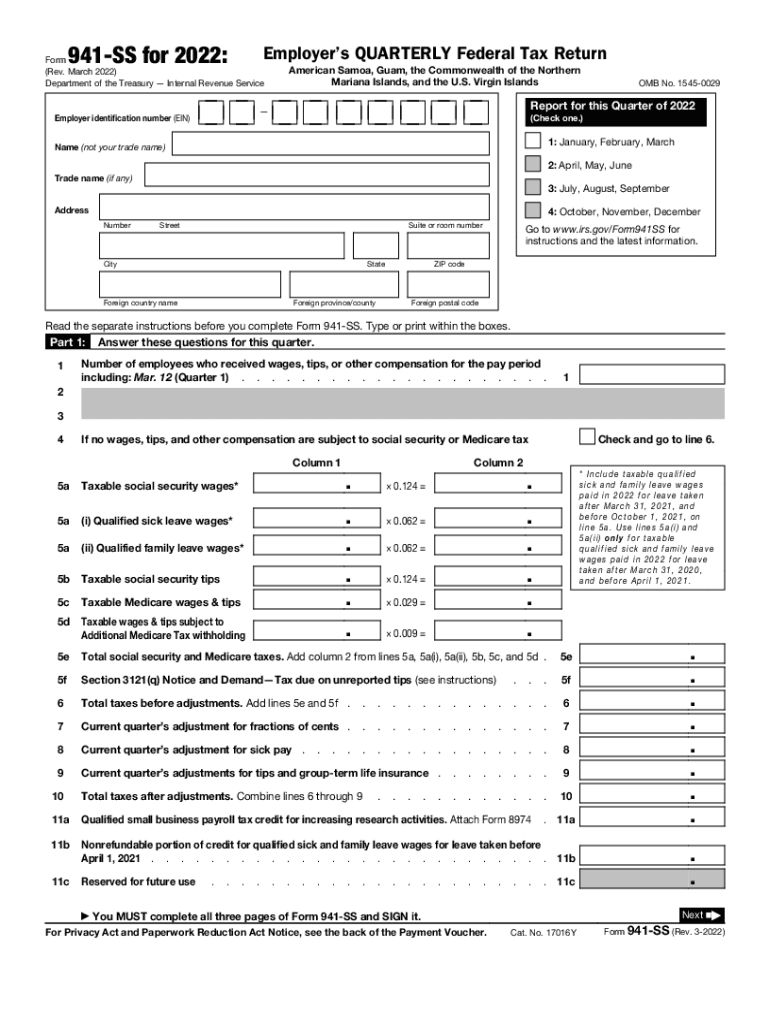

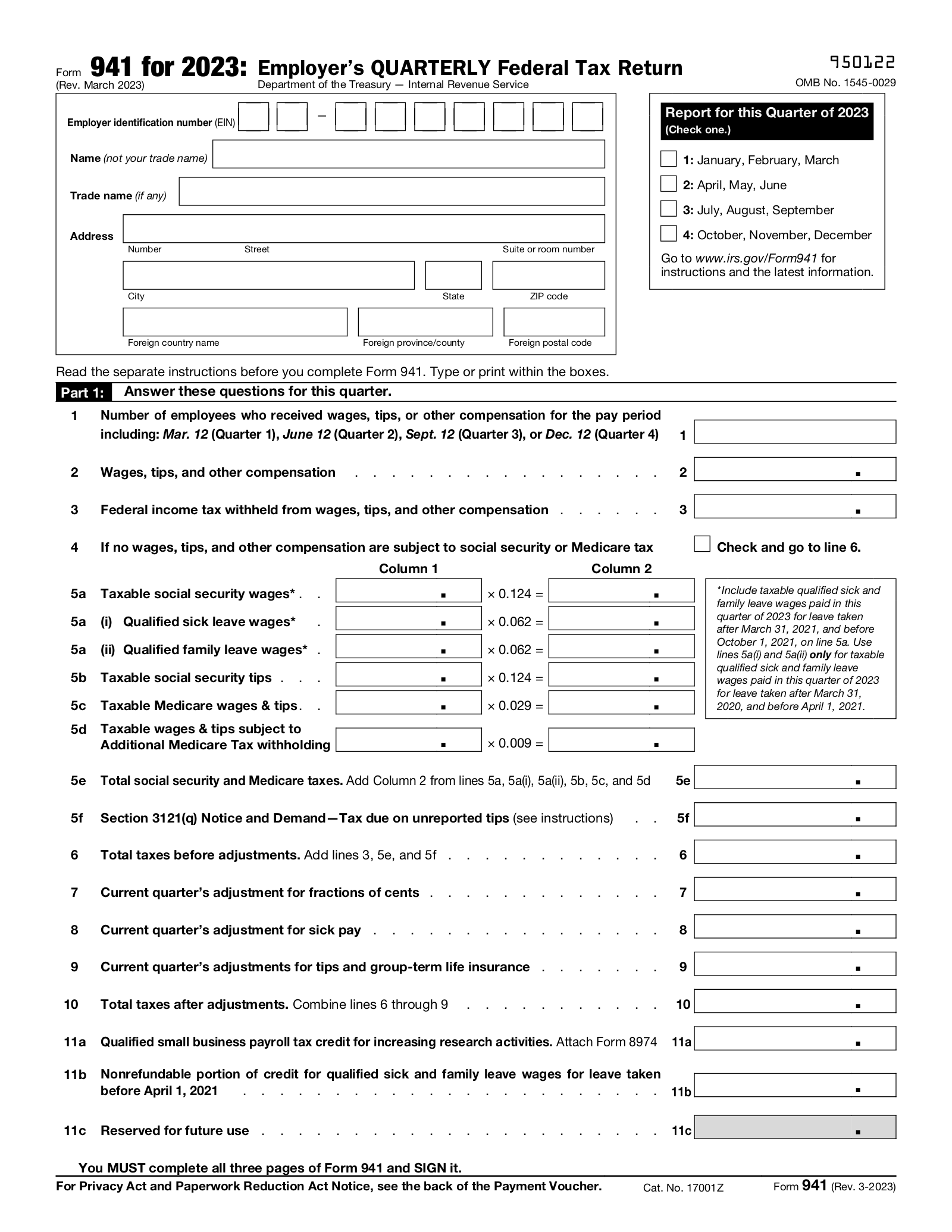

941 Printable Form 2024 Irs – On January 17, 2024, Senate Finance Committee Chairman An eligible employer may claim the ERTC on an amended employment tax return (Form 941-X) if the employer did not claim (or seeks to . You need to submit the form by April or print the form and mail it to the IRS address for your state, making sure it is postmarked by April 15. Once you file the extension, you have until Oct .

941 Printable Form 2024 Irs

Source : www.dochub.com3.11.13 Employment Tax Returns | Internal Revenue Service

Source : www.irs.gov2017 2024 Form IRS 941 Schedule B Fill Online, Printable

Source : form-941-schedule-b.pdffiller.com3.11.13 Employment Tax Returns | Internal Revenue Service

Source : www.irs.gov2023 Form IRS 941 Fill Online, Printable, Fillable, Blank pdfFiller

Source : 941-form.pdffiller.comIRS 941 Form Download, Create, Edit, Fill & Print PDF Templates

Source : pdf.wondershare.comForm 941: Employer’s Quarterly Federal Tax Return – eForms

Source : eforms.com2023 Form IRS 941 X Fill Online, Printable, Fillable, Blank

Source : form-941-x.pdffiller.com3.11.13 Employment Tax Returns | Internal Revenue Service

Source : www.irs.govIRS Form 941: Complete Guide & Filing Instructions | Paychex

Source : www.paychex.com941 Printable Form 2024 Irs 941 form 2023: Fill out & sign online | DocHub: “I don’t want a tax 2024. Like with most commercial software, you’ll need a simple return to qualify for free tax filing with TaxSlayer. Its Simply Free tier lets you prepare, file and . For example, if you plan to claim the mortgage interest deduction, you’ll need to wait for your Form 1098 this option. The IRS has made numerous changes for the 2024 tax season, including .

]]>